Risk of Day Trading

Day trading has its risks, but also great rewards if you know how to take advantages of opportunities. Market turmoils are bringing in risks as well as opportunities. CNBC just highlighted some risks for day trading:

Positive trade news will give Wall Street investors more confidence about the market, but “there’s more room to fall” without progress, Wharton School’s Jeremy Siegel said Friday.

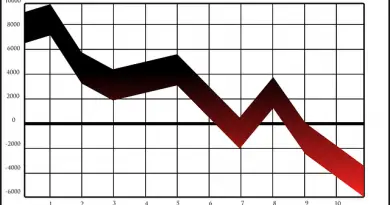

The Dow Jones Industrial Average tanked more than 623 points during the session. The S&P 500 plummeted 2.59%, and the Nasdaq Composite dropped 3%. The major averages all turned in their first 4-week losing streak since May.

Siegel, a finance professor at the University of Pennsylvania’s business school, noted that the VIX sprang nearly 20% to about 20 points during the trading day. The VIX, or CBOE Volatility Index, is a gauge that measures market risk based on investor sentiment of the S&P 500.

“We’ve seen it at 30 and 35 under uncertain conditions,” he said. That means “there is some hedging going on, but really not as much as there could be given uncertainty.”

Hedging is a move investors make in an attempt to offset the downward risk in one equity by investing in another. The move can reduce risk but at a cost to potential gains.” Read more…

To make money in this market, you need to position yourself so that you can endure long strings of losses, and maintain your day trading system. Day trading is a high risk game as it is very speculative in nature. Top day traders have a proven day trading system.

When a professional day trader prepares for the day’s market, he looks at much more than technical indicators. The most important component of a trading system is Money Management.

The most important question of a Trading System is how much to invest and how many positions to trade at the same time. You must know how to daytrade if you want to be a successful day trader. It is commonly stated that 80-90% of Day traders lose money.

An investor needs to have a system that helps him to be prepared for all scenarios of a trade. You’ll need to ascertain for yourself whether you are comfortable with the levels of risk inherent in day trading.. Remember that “educational” seminars, classes, and books about day trading may not be objective.

Day trading has become an online phenomenon in the last year which has resulted in manuals and courses on how to successfully day trade. There are a variety of online day trading services. Day traders should understand how margin works, how much time they’ll have to meet a margin call, and the potential for getting in over their heads.