Hedge funds can’t possibly survive the Nasdaq whale

THESE days, you don’t really need a professional to tell you how to make money. The rise of Big Tech alone has allowed investors in exchange-traded funds to recoup their March losses.

As for the more adventurous players, like SoftBank Group Corp’s Masayoshi Son, they can simply buy billions of dollars worth of call options, which has driven up demand and the price of FAANG stocks.

How can hedge funds possibly thrive in this world? Go big, or go home.

Even before the pandemic hit, funds with large, concentrated bets were gaining market share. Last year, event-driven funds, which seek to profit from certain situations like mergers or takeovers, saw US$11bil of inflows, while the hedge fund industry as a whole witnessed more than US$100bil of withdrawals, estimates eVestment Inc, a Nasdaq Inc company.

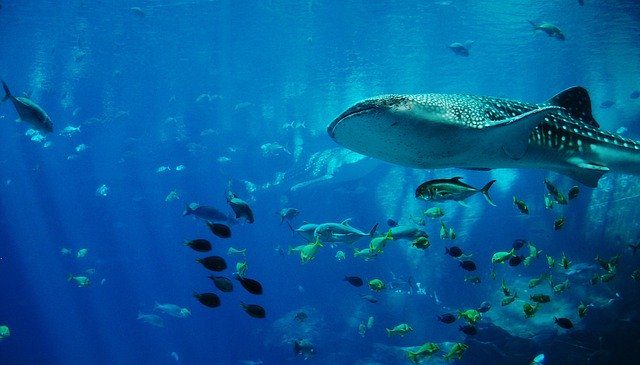

This is for good reason. Fund managers who consistently outperform tend to trade less, have higher tracking errors and more concentrated portfolios, Bernstein Research finds, using data from 2006 to 2019. Among top-performing managers, 27.7% have the most concentrated portfolios, compared with just 19.3% for the bottom fish.

This is perhaps not surprising. Star managers tend to have the strongest conviction – concentrated bets, as well as sharp deviation from benchmark indexes, are just expressions of that. Billionaire investor Stanley Druckenmiller certainly dispels the merit of…