Is Mortgage Interest Tax Deductible?

Mortgage interest is tax deductible. If you deduct your mortgage interest on your income tax return, you will be able to reduce the amount of taxes that you owe. This tax break does not apply to taxes paid for the purchase of your house, like state and local taxes. There is some confusion about the mortgage interest tax deduction, so here are a few tips on this topic to help you understand it more easily.

First of all, you cannot deduct your mortgage interest if you are taking the regular federal tax deduction. The regular federal tax deduction is only available to taxpayers who actually file a tax return. In 2020, the regular federal tax deduction is only available to taxpayers who pay at least $6,000 in income tax.

The mortgage interest tax deduction does not apply to loans secured by your home. A home mortgage is not considered to be a personal loan. That means, if you owe on a home mortgage loan but no longer own it, then you do not qualify for the mortgage interest tax deduction on your loan. However, if you do have an existing home mortgage, it may qualify you for the interest tax deduction.

If you own your home, you may be eligible for a home mortgage tax deduction on your first mortgage as long as you can demonstrate to the Internal Revenue Service that you plan on using the second mortgage for investment purposes. Home mortgage interest is not deductible when you use the second mortgage for any purpose other than investment. Even if you own your home, you may be able to claim your interest tax deduction if the home mortgage is for a short term only and the second mortgage is used for a long term investment.

Some people think that they may be eligible for the home mortgage tax deduction even if they have an adjustable rate mortgage. Unfortunately, most mortgage lenders will allow you to claim only the interest on the first year's amount, even if the interest rates go up during the first year. In other words, if your home mortgage is fixed at a certain amount for ten years and then increases to ten thousand dollars per year for the next ten years, you would not be able to claim any interest on your first mortgage. as the increased rates will not qualify you for a home mortgage interest tax deduction on it.

In some cases, homeowners may be able to claim their home mortgage tax deduction even if they have a modified adjusted basis for the home mortgage. that exceeds the current value of their home. For example, if the loan was acquired through a loan to buy their house, and the house was only worth one hundred fifty thousand dollars when the loan was acquired, then they may be eligible to claim the difference between this amount and the current value as a deduction. However, in order to get the benefit of this deduction, they must live in the home for three or more years.

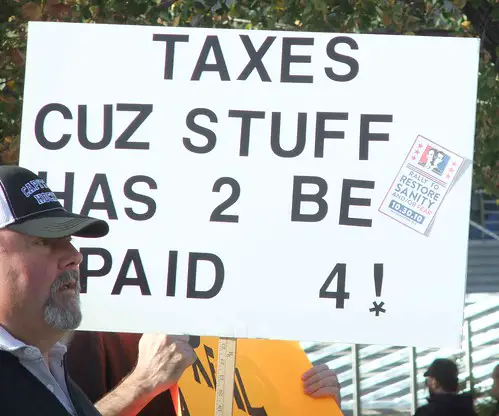

Photo by soukup