How to Trade With Implied Volatility

Last decade saw an implosion of volatility-related products,

With the launch of these ETPs, trading in volatility was no longer limited to the futures and options market, where it all began. Investors could finally place bets on volatility as easily as trading stocks.

Investors plowed billions of dollars into both long and short volatility ETPs, with assets of select leveraged and inverse volatility ETPs hitting about $4 billion by the end of 2017. Assets in top volatility-linked ETPs now stand at about $3 billion.

Volatility selling became such a rage that analysts warned that the trade was creating a feedback loop where the more investors sold volatility the lower it slipped. Read more...

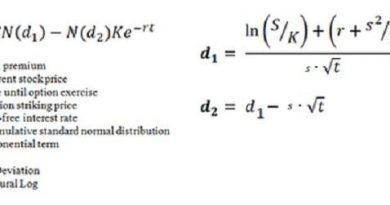

A broad term used with many financial instruments, each trader has their own style of volatility trading. In the institutional or hedge fund world, volatility is used as a measure of calculation to determine significant arbitrage opportunities. Commonly used with Exchange Traded Options and Shares, this strategy focuses on keeping a neutral risk position (ie delta neutral) and waiting for a change or mispricing in the option value to make a profit. The windows of opportunities are very narrow and require substantial bank roll to profit from such an approach.

The most common form of volatility trading can be adapted to all financial instruments. This style of trading focuses on pricing the volatility at a historical point to the relative or current volatility. Changes or spikes can indicate a number of possible factors including - economic, monetary policy, consumer sentiment, mispricing etc. Volatility traders will use this period to determine their position quantities and holding parameters.

The key question with volatility trading, is how to traders know when to execute an order. There are a number of technical tools which assist in the decision making process. These include:

VIX Technical Analysis

The VIX or Volatility Index has become significantly popular since the global financial crisis. Although it only tracks the option volatility of the S&P500, most traders highlight that this Chicago Board of Options Index is important in determining volatility levels. The significant weight of the S&P500 on the world markets is testament to this fact.

VIX is determined by the weighted average of options pricing in the S&P500. These spikes would only occur if there was significant volatility in the underlying stock. The chart below highlights the volatility levels in the VIX since 1990. As is apparent on the chart, the recent economic events, saw record levels of volatility come into the markets.

Chaikin Volatility: This is a less known technical indicator focusing on the differences between short and long term moving averages. The chaikin volatility indicator focuses on subtracting the longer term moving average from the short term accumulation / distribution moving average. Not a popular indicator due to its complexity, the chaikin volatility chart is quite useful when used in conjunction with the VIX chart.

Volatility is a key measure of market sentiment and can be used effectively as a trading strategy. A number of important factors to keep in mind when volatility trading include leverage (heightened forms of leverage during price swings can cause substantial losses and gains), and risk management (stop losses are extremely important during severe levels of volatility in the markets).