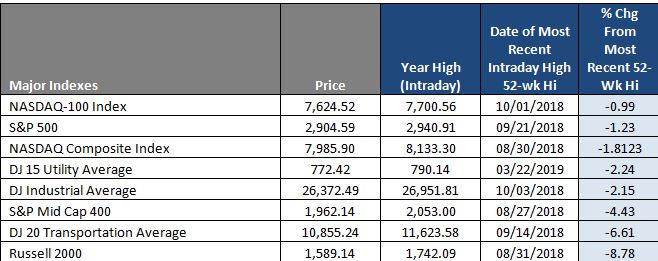

Stocks are at an inflection point that could take the market to new highs

*Prices as of opening Friday, April 5, 52-week high represents all-time high

That was followed by J.P. Morgan’s strong earnings and CEO Jamie Dimon’s comments that the U.S. economy was strong. The third driver was Chevron’s $33 billion acquisition of Anadarko, which sparked a rally in the energy sector as traders speculated on more deals.

“You put all three together and now all of a sudden, we’re here at 2019 highs with 2,940 the next key spot,” Redler said.

First quarter earnings are expected to see the first actual profit decline since 2016. According to FactSet, analysts expect a 4.2 percent drop in S&P 500 earnings. However, analysts are divided on whether the second quarter will be positive or negative, so the company guidance after current quarter results will be crucial to the market’s valuation.

“It’s going to be the first quarter earnings that are going to take us another leg higher. If they’re not great or a lot of companies guide lower, there will not be much more upside,” said Redler. While just one report, J.P. Morgan is a bellwether for the market and financials, a key group that could help push the market to its highs.

Financial shares were higher with J.P.